Understanding the intricacies of credit scores is crucial to financial health. A good credit score can open doors to lower interest rates, better financial opportunities, and a sense of financial security. This guide will delve into the world of credit score improvement and management, providing actionable steps and insights to help you navigate this often complex landscape. If you start searching the options below, you can find the best deals for you.

Understanding Credit Scores

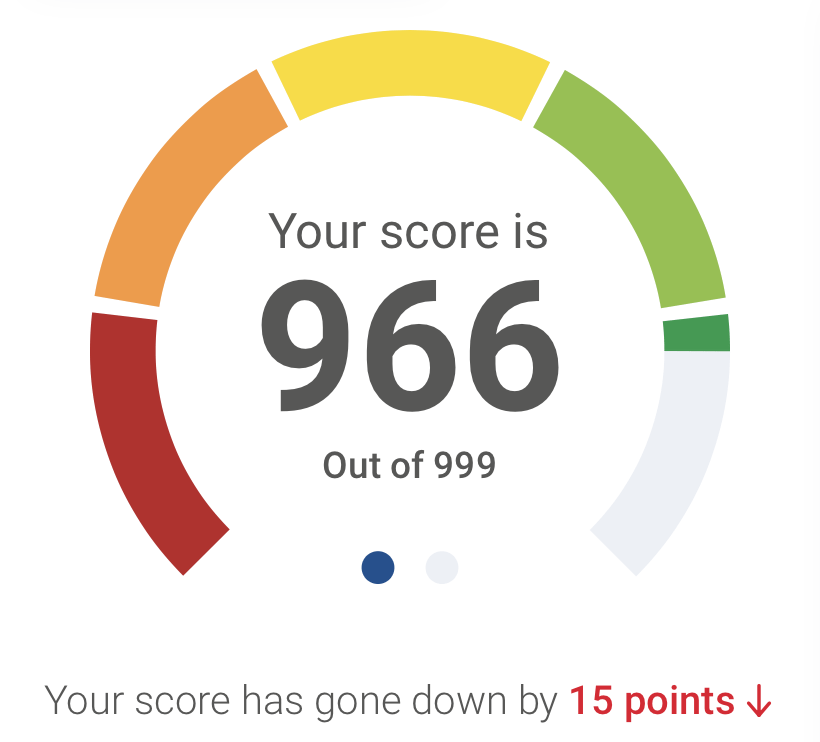

A credit score is a numerical representation of your creditworthiness, based on an analysis of your credit files. Lenders use credit scores to assess the likelihood that you will repay your debts on time. The higher your score, the more likely you are to be approved for loans and receive lower interest rates.

Credit scores are calculated using various factors, including your payment history, the amount of debt you owe, the length of your credit history, the types of credit you have, and recent credit inquiries. Understanding these factors can help you manage and improve your credit score.

Payment History

Your payment history is the most significant factor in your credit score. It reflects whether you’ve paid your credit accounts on time. Late payments, defaults, and bankruptcies have a negative impact on your credit score.

To improve your credit score, it’s crucial to make all your payments on time. If you’ve missed payments, get current and stay current. Over time, this will have a positive impact on your credit score.

Amount of Debt

The amount of debt you owe also impacts your credit score. This is measured by your credit utilization ratio, which is the percentage of your available credit that you’re using. A high credit utilization ratio can negatively impact your credit score.

To manage your credit score, try to keep your credit utilization ratio low. Aim to use no more than 30% of your available credit. Paying down debts and increasing your credit limit can help lower your credit utilization ratio.

Steps to Improve Your Credit Score

Improving your credit score requires a strategic approach. Here are some steps you can take to improve your credit score over time.

- Review your credit reports

- Dispute any errors

- Pay your bills on time

- Reduce your debt

- Limit new credit inquiries

Review Your Credit Reports

Regularly reviewing your credit reports can help you understand your financial standing and identify any errors that may be impacting your credit score. You’re entitled to a free credit report from each of the three major credit bureaus every year.

When reviewing your credit reports, look for any inaccuracies in your personal information, credit accounts, and public records. If you spot any errors, dispute them with the credit bureau.

Dispute Any Errors

If you find errors on your credit report, it’s essential to dispute them as they can negatively impact your credit score. You can dispute errors by contacting the credit bureau that issued the report. The bureau is required to investigate your dispute within 30 days.

When disputing errors, provide as much information as possible to support your claim. This may include copies of documents that prove your claim. If the bureau agrees with your dispute, they will correct your credit report, which can improve your credit score.

Effective Credit Score Management

Managing your credit score effectively requires consistent effort and a strategic approach. Here are some strategies to help you manage your credit score effectively.

- Keep balances low on credit cards

- Don’t close unused credit cards

- Only apply for new credit when necessary

- Have a mix of credit types

Keep Balances Low on Credit Cards

Keeping your credit card balances low can help improve your credit score. This is because it lowers your credit utilization ratio, which is a significant factor in your credit score. Aim to keep your balances below 30% of your credit limit.

One strategy to keep your balances low is to make multiple payments throughout the month. This can help you manage your credit utilization ratio and improve your credit score over time.

Don’t Close Unused Credit Cards

Closing unused credit cards can negatively impact your credit score as it can increase your credit utilization ratio. It can also shorten your credit history, which is another factor in your credit score.

Instead of closing unused credit cards, consider using them for small purchases that you can pay off in full each month. This can help keep the card active and improve your credit score over time.

Improving and managing your credit score is a journey, not a destination. It requires consistent effort, strategic planning, and patience. But with the right approach, you can improve your credit score and open doors to better financial opportunities.