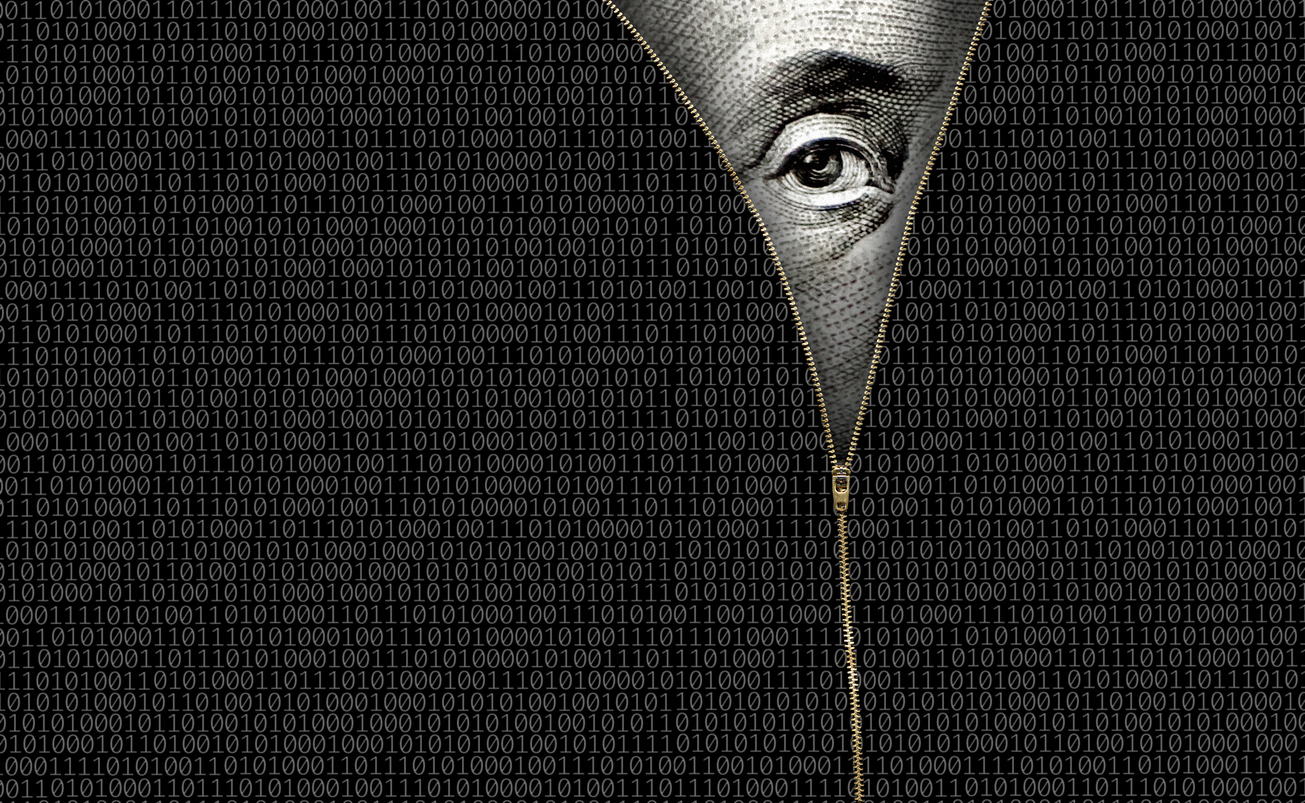

In the world of banking, transparency is often touted as a key principle. However, the reality is that banks, like any other businesses, have their secrets. These secrets can range from hidden fees to undisclosed policies that could impact your financial health. This article will delve into the various secrets your bank might be hiding and how you can uncover them. If you start searching the options below, you can find the best deals for you.

Hidden Fees and Charges

One of the most common secrets banks hide are the fees and charges associated with their services. While some of these costs are clearly outlined in the terms and conditions, others are buried deep within the fine print, making them easy to overlook.

These hidden fees can include maintenance fees, ATM fees, overdraft fees, and more. They can quickly add up, eating into your savings without you even realizing it. Therefore, it’s crucial to read the fine print carefully before signing up for any banking service.

Moreover, banks often change their fee structures without explicitly informing their customers. This means that you could be paying more for a service without even knowing it. To avoid this, regularly review your bank statements and question any charges you don’t recognize.

How to Uncover Hidden Fees

Uncovering hidden fees requires a proactive approach. Start by thoroughly reading your bank’s terms and conditions. Look for any mention of fees or charges, and don’t hesitate to ask for clarification if something isn’t clear.

Next, review your bank statements regularly. Look for any charges that you don’t recognize or understand. If you find anything suspicious, contact your bank immediately for clarification.

Finally, consider using online tools and resources that can help you identify hidden fees. Websites like BankFeeFinder.com can provide valuable insights into the fee structures of various banks, helping you make an informed decision.

Undisclosed Policies

Banks often have policies that they don’t disclose upfront. These policies can affect your ability to access your money, the interest rates you receive, and more. For example, some banks have policies that limit the number of withdrawals you can make from your savings account each month. Others may have policies that penalize you for not maintaining a minimum balance.

These undisclosed policies can have a significant impact on your financial health. Therefore, it’s important to understand all the policies associated with your bank account, not just the ones that are clearly stated.

Moreover, banks often change their policies without explicitly informing their customers. This means that the rules you agreed to when you opened your account may no longer apply. To avoid any unpleasant surprises, regularly review your bank’s policies and stay informed about any changes.

How to Uncover Undisclosed Policies

Uncovering undisclosed policies requires a bit of detective work. Start by reading your bank’s terms and conditions thoroughly. Look for any mention of policies or rules, and don’t hesitate to ask for clarification if something isn’t clear.

Next, stay informed about any changes to your bank’s policies. This can be done by regularly checking your bank’s website or subscribing to their newsletter. If you notice any changes that you don’t understand, contact your bank for clarification.

Finally, consider using online resources that can help you understand your bank’s policies. Websites like ConsumerFinance.gov provide valuable information about banking policies and regulations, helping you make informed decisions.

Opaque Interest Rates

Interest rates are a key factor in determining the growth of your savings or the cost of your loans. However, banks often keep their interest rate structures opaque, making it difficult for customers to understand how much they’re truly earning or paying.

For example, some banks advertise high interest rates for their savings accounts, but these rates only apply if you maintain a certain balance or meet other specific criteria. If you don’t meet these criteria, you’ll receive a much lower rate.

Similarly, banks often advertise low interest rates for their loans, but these rates are usually reserved for customers with excellent credit. If your credit is less than perfect, you’ll likely be offered a higher rate.

How to Uncover Opaque Interest Rates

Uncovering opaque interest rates requires a thorough understanding of how interest rates work. Start by learning about the different types of interest rates and how they’re calculated. This will help you understand what you’re truly earning or paying.

Next, ask your bank for a detailed breakdown of their interest rates. This should include any conditions or criteria that need to be met to receive the advertised rate. If anything isn’t clear, don’t hesitate to ask for clarification.

Finally, consider using online tools and resources that can help you compare interest rates. Websites like Bankrate.com provide valuable insights into the interest rates offered by various banks, helping you make an informed decision.

Banks, like any other businesses, have their secrets. These secrets can impact your financial health, so it’s crucial to uncover them. By being proactive and staying informed, you can ensure that you’re getting the most out of your banking services.

Remember, knowledge is power. The more you know about your bank’s fees, policies, and interest rates, the better equipped you’ll be to make informed financial decisions. So don’t be afraid to dig deep and uncover the secrets your bank might be hiding.